"Platform Based Payment Gateway Market Size And Forecast by 2032

The Platform Based Payment Gateway Market is a rapidly expanding industry that plays a critical role in shaping global economic dynamics. With its remarkable size, share, and scope, the market has become a focal point for innovation, investment, and growth. This comprehensive research report delves into the market's evolution, offering insights into its current performance and future outlook. It examines key factors such as demand, growth drivers, and revenue trends that are shaping the industry's trajectory.

The global platform based payment gateway market size was valued at USD 26.37 billion in 2024 and is projected to reach USD 33.93 billion by 2032, with a CAGR of 3.20% during the forecast period of 2025 to 2032. I

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-platform-based-payment-gateway-market

Which are the top companies operating in the Platform Based Payment Gateway Market?

The Top 10 Companies in Platform Based Payment Gateway Market are prominent players known for their leadership and innovation. These include companies recognized for their strong product offerings and market influence. These companies have built solid reputations through their commitment to quality, customer satisfaction, and staying ahead of industry trends, making them key competitors in the Platform Based Payment Gateway Market.

**Segments**

- **By Type**: The platform-based payment gateway market is segmented into hosted payment gateways and non-hosted payment gateways. Hosted payment gateways are ideal for businesses that want to outsource payment processing to a third-party provider, ensuring secure transactions for customers. On the other hand, non-hosted payment gateways give businesses more control over the payment process by allowing them to handle transactions directly on their platform. Both types cater to different business needs and preferences, leading to a diversified market landscape.

- **By End-User**: The market is further segmented based on end-users such as large enterprises, small and medium-sized enterprises (SMEs), and individual users. Large enterprises often require complex payment solutions to manage a high volume of transactions efficiently. SMEs, on the other hand, may prioritize cost-effective and user-friendly payment gateways that cater to their specific business requirements. Individual users seek secure and convenient payment options for seamless online transactions.

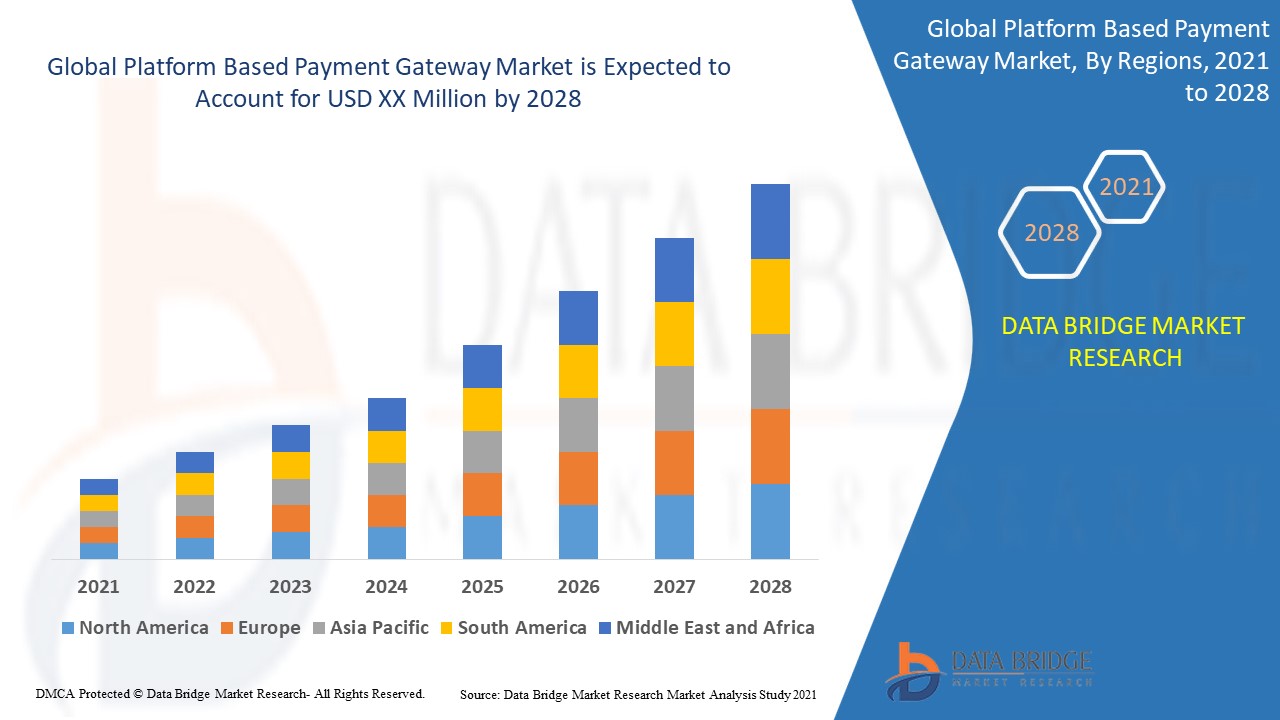

- **By Geography**: Geographically, the platform-based payment gateway market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region presents unique opportunities and challenges for market growth. North America, being technologically advanced, holds a significant market share due to the early adoption of digital payment solutions. Asia Pacific is witnessing rapid growth attributed to the increasing e-commerce activities and digital penetration in emerging economies.

**Market Players**

- **PayPal Holdings, Inc.**: One of the leading players in the platform-based payment gateway market, PayPal offers a secure and convenient payment gateway for businesses and individual users worldwide. With advanced fraud protection and seamless integration capabilities, PayPal remains a preferred choice for online transactions.

- **Stripe, Inc.**: Stripe is known for its developer-friendly payment gateway solutions that enable businesses to accept online payments effortlessly. With a focus on scalability and customization, Stripe caters to a wide range of industries and business sizes, making it a prominent player in the market.

- **Adyen N.V.**: Adyen distinguishes itself in the market by providing a unified payment platform that supports various payment methods and currencies globally. Its omnichannel payment solutions and robust security features have positioned Adyen as a trusted payment gateway provider for businesses across different sectors.

- **Square, Inc.**: Square offers a diverse range of payment processing services, including in-person, online, and mobile payments, catering to the evolving needs of modern businesses. Its easy-to-use platform and competitive pricing strategies have contributed to its popularity among SMEs and individual users in the digital payment ecosystem.

The platform-based payment gateway market is poised for substantial growth driven by the increasing shift towards digital transactions, the rise of e-commerce activities, and the need for secure payment solutions. As technology continues to evolve, market players are expected to focus on innovation, partnerships, and enhancing user experience to stay competitive in this dynamic landscape.

https://www.databridgemarketresearch.com/reports/global-platform-based-payment-gateway-market The platform-based payment gateway market is experiencing significant growth trends that are reshaping the industry landscape. One emerging trend is the increasing focus on enhancing security measures to combat fraud and protect sensitive customer data. As cyber threats continue to evolve, payment gateway providers are investing in advanced encryption technologies, biometric authentication, and fraud monitoring tools to ensure secure transactions for businesses and individual users alike. This emphasis on security not only builds trust among consumers but also helps businesses mitigate risks associated with online payments, fostering long-term relationships with their customers.

Another key trend in the market is the growing demand for seamless omnichannel payment solutions that enable businesses to accept payments through multiple channels, including websites, mobile apps, social media platforms, and in-store transactions. The rise of digital commerce and the expansion of online retail have created a need for payment gateway providers to offer versatile and integrated payment options that cater to the diverse preferences of consumers. By providing a unified payment experience across various touchpoints, businesses can streamline their operations, enhance customer satisfaction, and drive revenue growth in an increasingly competitive market environment.

Moreover, the market is witnessing a surge in strategic partnerships and collaborations between payment gateway providers, financial institutions, technology companies, and e-commerce platforms. These partnerships are aimed at enhancing interoperability, expanding market reach, and driving innovation in payment solutions. By leveraging each other's strengths and resources, companies in the payment gateway space can create synergies that lead to the development of cutting-edge technologies, personalized customer experiences, and new business models that address evolving market demands.

Furthermore, regulatory developments and compliance requirements are shaping the competitive dynamics of the platform-based payment gateway market. With the introduction of stringent data protection regulations such as GDPR and PSD2, payment gateway providers are under increasing pressure to adhere to strict guidelines to ensure data privacy and transparency in financial transactions. Compliance with regulatory standards not only fosters trust among consumers but also demonstrates a commitment to ethical business practices, which is becoming a key differentiator in the crowded payment gateway market.

In conclusion, the platform-based payment gateway market is undergoing a transformative period driven by evolving customer preferences, technological advancements, regulatory changes, and industry collaborations. To thrive in this dynamic landscape, market players need to stay agile, innovate continuously, and prioritize customer-centricity to meet the evolving needs of businesses and individual users seeking secure, seamless, and integrated payment solutions in the digital era. As the market continues to evolve, opportunities for growth and differentiation will emerge for those that can adapt quickly and deliver value-added services that set them apart from competitors.**Segments**

Global Platform Based Payment Gateway Market, By Application (Micro and Small Enterprises, Large Enterprises, Mid-Size Enterprises), End user (BFSI, Medi Entertainment, Retail & E-commerce, Travel & Hospitality, Others), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2032.

- The market for platform-based payment gateways is segmented based on application, end-user industries, and country-specific trends. Micro and small enterprises, large enterprises, and mid-size enterprises have varying payment gateway needs. Different industries such as BFSI, Media & Entertainment, Retail & E-commerce, and Travel & Hospitality utilize payment gateways differently. Various countries exhibit unique market trends and preferences leading to a diverse landscape for platform-based payment gateways.

**Market Players**

- The major players covered in the platform-based payment gateway market report are Alipay, Amazon, Inc., Wirecard, PesoPay, PayU, PayPal, Paymill, MOLPay, eWAY AU, Net, Worldpay, Beanstream, Stripe, Klarna, Realex, CashU, WebMoney, Pagosonline, 99bill, MyGate, ServiRed, Payson, Cardstream, Sage Pay, e-Path, NAB Transact, eWAY AU, MercadoPago, CCBill among other domestic and global players. Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and South America separately. Competitive analysis for each competitor is provided, with an understanding of their strengths and positioning in the market landscape.

The platform-based payment gateway market is witnessing dynamic shifts fueled by technological advancements, changing customer preferences, and regulatory environments. The emphasis on security measures to combat fraud and protect customer data is paramount, with investments in encryption technologies and fraud monitoring tools. Omnichannel payment solutions cater to the diverse needs of consumers and businesses across multiple platforms, driving demand for integrated payment options. Strategic partnerships and collaborations are fostering innovation, expanding market reach, and enhancing payment solutions.

Regulatory compliance, especially with data protection regulations like GDPR and PSD2, is shaping market dynamics, emphasizing data privacy and transparency in financial transactions. Market players need to stay agile, innovate continuously, and prioritize customer-centricity to meet evolving demands. The competitive landscape is influenced by industry collaborations, technological innovations, and the development of cutting-edge payment solutions. For businesses in the platform-based payment gateway sector, staying ahead in this evolving environment requires a forward-looking approach and a commitment to delivering value-added services that differentiate them in the market.

Explore Further Details about This Research Platform Based Payment Gateway Market Report https://www.databridgemarketresearch.com/reports/global-platform-based-payment-gateway-market

Key Insights from the Global Platform Based Payment Gateway Market :

- Comprehensive Market Overview: The Platform Based Payment Gateway Market is experiencing robust growth driven by technological advancements and increasing consumer demand.

- Industry Trends and Projections: The market is projected to expand at a CAGR of X% over the next five years, with a significant shift towards sustainability.

- Emerging Opportunities: Growing demand for innovative products and services presents new business opportunities in niche segments.

- Focus on R&D: Companies are investing heavily in research and development to stay ahead in a competitive market landscape.

- Leading Player Profiles: Key players include known for their market leadership and innovation.

- Market Composition: The market is fragmented, with both large corporations and small enterprises playing vital roles.

- Revenue Growth: The market has seen a steady increase in revenue, driven by strong consumer adoption and product diversification.

- Commercial Opportunities: Businesses can capitalize on untapped regional markets and technological advancements to gain a competitive edge.

Find Country based languages on reports:

https://www.databridgemarketresearch.com/jp/reports/global-platform-based-payment-gateway-market

https://www.databridgemarketresearch.com/zh/reports/global-platform-based-payment-gateway-market

https://www.databridgemarketresearch.com/ar/reports/global-platform-based-payment-gateway-market

https://www.databridgemarketresearch.com/pt/reports/global-platform-based-payment-gateway-market

https://www.databridgemarketresearch.com/de/reports/global-platform-based-payment-gateway-market

https://www.databridgemarketresearch.com/fr/reports/global-platform-based-payment-gateway-market

https://www.databridgemarketresearch.com/es/reports/global-platform-based-payment-gateway-market

https://www.databridgemarketresearch.com/ko/reports/global-platform-based-payment-gateway-market

https://www.databridgemarketresearch.com/ru/reports/global-platform-based-payment-gateway-market

Data Bridge Market Research:

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975